How to buy shares in India?

Every body eagerly want to become wealthy and rich. But how? Their are so many way to earn, one can start blogging, become investor by trading shares, FOREX, commodities, starting new business etc. Usually working for someone you can’t achieve great fortune. Individuals must start their own business. In other words 9-5 won’t make you rich, but 24/7 will do.

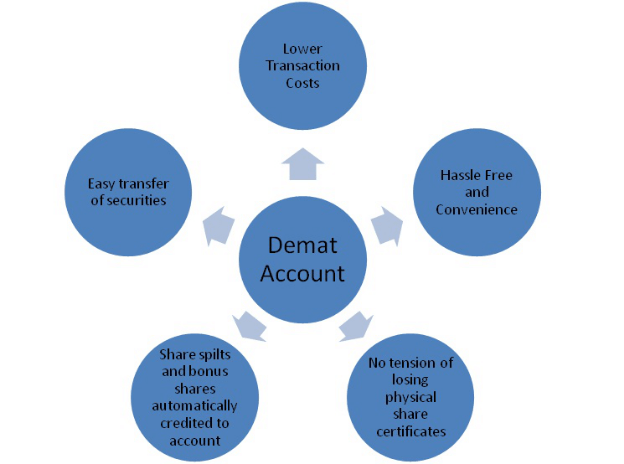

Although our main focus here is trading shares. Since doing business requires more knowledge and more money compared to trading. Anybody can buy shares using Demat account (Dematerialized account).

Initially stocks was sold as paper bonds known as physical shares. Nowadays physical shares are converted into digital form, this process is known as dematerialization.

Investors who wants to invest in shares need Demat account with Depositary Participant (DP). In India NSDL and CDCL are the only two DPs. DPs will manage all the trades in digital forms.

Who are Depositary Participant (DP) ?

DPs are the market brokers through these bodies investors can claim the depository services. DPs involves custodians, banks, brokers and financial institutions to provide the Demat services.

Advantages of Dematerialized shares over physical shares

- Easy to maintain digital shares rather than physical shares.

- There is a chance of loosing physical paper shares, they may tear.

- Transfer between two individuals is easy.

- One should by multiple physical shares in terms of lots, we can buy even 1 dematerialized share.

- Liquidating shares is easy.

- Investors need not to pay stamp duty to transfer.

- There is no transit loss while transfer, dividend, split and bonus shares.

- Ones brokerage is less compared to physical shares demat shares.

How to open Demat account?

Now we know Dmat account is necessary to trade shares. How to open Dmat account? Who will provide this? What are the documents necessary? I am going to explain below.

Necessary documents

- Active bank account with 2 check leave, 3 months bank statement.

- PAN card.

- Any proof of identity like Driving licence, Adhar card, Voter ID, Passport etc.

Note : – Name, Date of Birth and address should not be different in the above mentioned documents.

Dmat providers in India.

Almost all banks like HDFC, ICICI, SBI etc, and private financial institutions like Zerodha, Sharekhan, IIFL, Religare etc will provide the Demat account. Personally I use Zerodha. One main demerit of Zerodha is we can’t subscribe to IPOs.

Actual process

If you have all the necessary documents mentioned above, just visit the financial institutions they will welcome you like anything. They will take care of remaining process.

Finally individuals need to fill the form, submit above mentioned documents with 2 crossed check leave, with 3 months bank statement. After the completion of above all process, within one week your Demat account will be active. Now you can trade on Indian market like BSE and NSE. Now you can trade on Indian markets. But now the question is what shares to trade.

Which shares to trade?

Before trading shares you need lot of analysis, paper work and practice. High risks and high returns are the two faces of trading shares. Subject of shares is vast than your degree syllabus. How to analyse, what are good shares for beginners? How to earn money by trading shares?

Stack analysis

There two methods to analyse stocks

- Fundamental analysis or Value investing or Qualitative stock analysis

- Technical Analysis or Quantitative stock analysis

Fundamental stock analysis

Fundamental stock analysis or value investing, involves evaluating actual value of a company. value investing is the foundation of investment. Investing and trading is different. One who hold stocks for log term is investor. Following ratios are very important while doing Qualitative stock analysis.

- Market capitalization

- Face value

- Book value

- ROI

- P/E ratio

- EPS

- PEG ratio

- Current ratio

- Quick ratio

- Debt to equity ratio

- Promoter quota

Technical analysis on stocks

Technical analysis is nothing but, predicting the stock market trends. However technical analysis is suitable for day trader, swing traders. In other words it is suitable for short term traders.

Although technical analysis users various charts like candlestick chart, bar chart, line chart along with the moving averages, RSI etc. Following are the main building blocks of technical analysis.

- Candlestick charts

- MACD

- Moving average

- RSI

- Pivot Points

- Stochastics

- Volume Chart

- Bollinger Bands

Trading tools and Applications

- screener.in

- moneycontroll.com

- investing.com

- Amibroker

- BSE

- NSE

- Economic times

- Stock trainer app for android

Money is not essential to learn trading

It’s true, although you can learn stock market using Stock trainer app for android. This is the best stock market simulator, here you will get ₹5,00,000 to invest. Analyse the stocks using ‘screener.in’, test your strategies then start investing in real market.

Similarly you can track your strategies by creating portfolio in ‘moneycontroll.com’ or you can write and compare the stocks on paper. Do what you feel better. But don’t invest without analysing, first learn, learn, learn then earn, earn, earn….

Simultaneously you can gain knowledge through blogs, magazines, newspapers, T.V. Shows. Economic Times and Dalal Street Investment journal are some good sources.

However log term investment attract more profits, than short term investment, since short term investors need to pay a lot of tax and brokerage. Log term investors make money while dividends, stock splits and bonus shares.

Primary market and secondary market

Initially shares are issued by the company as Initial public offering (IPO), here investors need to bid and subscribe to them. Here our more focus is secondary market. Secondary market is actually called stock exchanges. In which we trade stocks.

Trading hours

Individuals can trade on stocks in market hours only. Below is the market timings.

- Monday to Friday 9:15 AM to 3:30 PM

- Saturdays and Sundays are holidays

- All Government holidays are trading holidays